A new index, seeking to measure the walkability of commercial sectors to help better determine value and potential investment opportunities, shows strong consumer preference for urban cores.

Real Capital Analytics Inc., an international data and analytics firm focused on commercial real estate investment markets, announced a new collaboration with WalkScore, a private company providing a numerical index of community walkability via websites and a mobile app. The companies called the RCA & Walk Score Commercial Property Price Indices (CPPI) “the first of its kind to quantify the price value of walkability for commercial properties.”

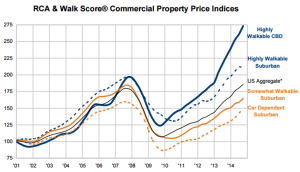

“Prices for commercial properties in highly walkable locations show significantly greater appreciation trends than car-dependent locations,” said RCA Founder Robert White in a release accompanying the announcement. “The findings cut across both urban and suburban locales, large and small markets and each of the office, retail and apartment sectors.”

“Prices for commercial properties in highly walkable locations show significantly greater appreciation trends than car-dependent locations,” said RCA Founder Robert White in a release accompanying the announcement. “The findings cut across both urban and suburban locales, large and small markets and each of the office, retail and apartment sectors.”

RCA says the first-quarter results for this year will be released next month. The current release analyzes data through December 2014. RCA says the data “supports growing evidence that demographic shifts and preferences have shifted back to urban locations and more dynamic live/work/play environments.”

They found that over the past decade, prices for properties located in central business districts have risen 125 percent, while comparable properties located in car-dependent areas have risen only around 20 percent during the same time period. And properties don’t have to be located in purely urban areas to benefit; the index finds that prices for suburban properties that are also considered highly walkable are up 43 percent.